Disclaimer: Investing/Trading in securities including NFTs are subject to market risks and there is no assurance or guarantee of returns – neither the principal nor appreciation on the investments. Khaleejesque and its employees are neither responsible nor liable for any losses resulting from the investments based on the views shared in this interview. Kindly seek advice from your financial planner before investing. User discretion advised.

NFTs (Non-Fungible Tokens) is a term we are hearing echoed across the art world. Best described as a unique digital asset that has its own identifying unique code, it can be bought and sold online mostly through cryptocurrency. An NFT can be thought of as a certificate that only exists once, is unique, immutable and cannot be interchanged. When a collector buys an NFT, they are buying a token (or certificate) and thus the singular digital artwork or photograph linked to it. The purchase of the NFT is registered on the blockchain (a decentralised database) and provides a permanent record of that purchase and proof of ownership.

As the popularity of NFTs continues to soar, navigating the associated financial implications becomes increasingly crucial. Engaging the services of a crypto tax accountant can be instrumental in managing the tax complexities tied to NFT transactions. These financial experts possess the specialized knowledge to assist collectors and creators alike in understanding and optimizing their tax obligations within the dynamic crypto landscape. By seamlessly integrating the expertise of a crypto accountant, individuals can ensure compliance with evolving regulations and make informed financial decisions, fostering a secure and transparent environment for participants in the NFT market.

Furthermore, with the rise of various tools and platforms designed to enhance trading strategies, one such example is Immediate Flex fake, which showcases how a blend of technology and education can create more efficient ways to navigate the space. By offering simulations and real-time market data, such tools help investors understand the intricacies of NFT trading and foster greater confidence in their decision-making processes. With access to these innovative resources, individuals can refine their strategies, maximizing their investment potential while staying up to date with the latest developments in the NFT market.

The first NFT was minted in 2014, but it is in the last 18 months that there has been a meteoric rise in the number of people that are interacting and collecting NFTs. They are now an integral part of the digital art world as they provide an exciting platform to invest in via fixed price or a virtual auction. These unique assets are built on blockchain and can be bought and sold on purpose-built NFT marketplaces.

Sotheby’s is the first auction house, and one of the only organisations in the world, to create its own platform dedicated to NFTs, with the launch of Sotheby’s Metaverse. By launching this exciting new platform, Sotheby’s has enabled digital artists to sell and market their work in their native states and expanded their reach and welcomed a new audience to the collecting community.

Since its debut auction in April 2021, Sotheby’s sales in this category have achieved approximately $100 million for 100 NFTs, setting multiple benchmarks along the way, including records for a single CryptoPunk ($11.8 million) and single Bored Ape ($3.4 million).

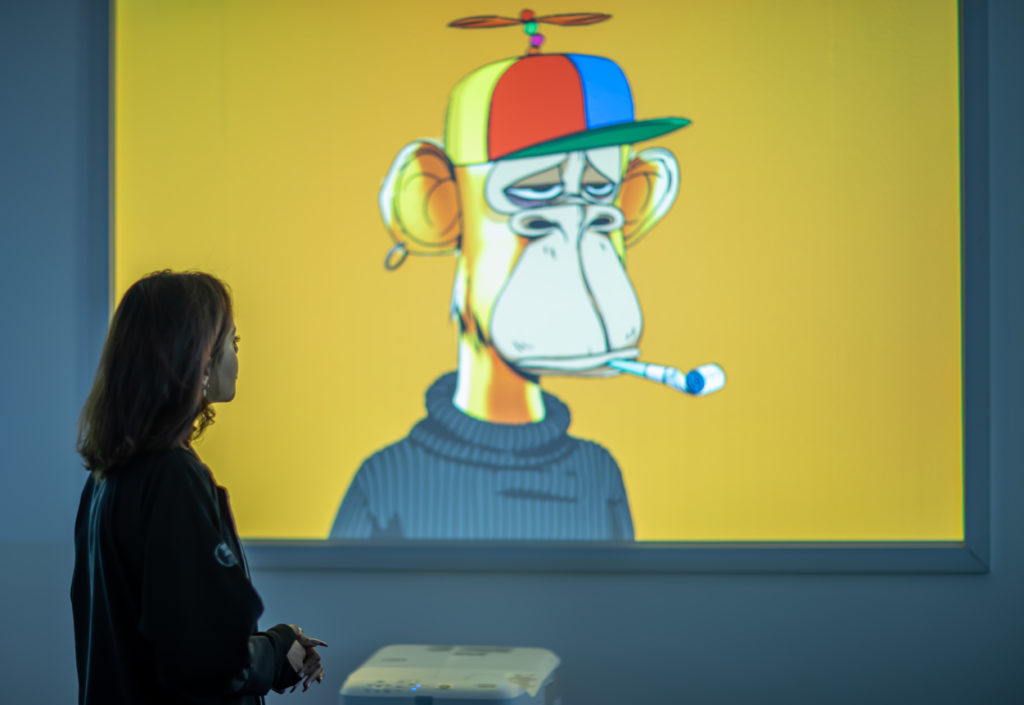

In February 2022, Sotheby’s and the Visual Arts Commission of Saudi Arabia’s Ministry of Culture partnered to launch a Digital Arts Forum in the Kingdom. The first of its kind in the Middle East, it took place in Riyadh from 25-27 February, 2022. Charting the history of NFTs, from their inception seven years ago until today, the dedicated talks program brought together the pioneering artists, collectors and curators that are defining the space. Over the course of three days, attendees had the opportunity to join a series of talks by experts in art, blockchain technology and NFTs. Sotheby’s also showcased a selection of cutting-edge NFTs and hosted daily workshops as part of the Diriyah Biennale’s public program.

We sat down with Sebastian Fahey, Managing Director of Sotheby's EMEA, to speak about the exciting world of NFTs and learn more about it from Sotheby’s experience and perspective.

Saira Malik (S.M): What makes NFTs exciting enough for Sotheby’s to also adopt this contemporary form of art?

Sebastian Fahey (S.F.): The idea of NFTs has been around for years and we have been watching the space closely. We wanted to enter fully armed with the right expertise and at the right time for the market. I think that we are still at the very beginning of this fast-growing category, so it is very difficult to predict its evolution on a long-term vision, but NFTs are certainly here to stay. The technology is certainly one of the greatest innovations in the art market, both for the art and for the asset.

For us NFTs are a once in a generation opportunity to create a bridge between the world of digital art to the physical art world, and vice versa. NFTs have provided us the opportunity to work with a new generation of artists and curators who are creating truly unique works of a kind we haven’t seen before. This is a space for experimentation in which the possibilities are endless and constantly evolving.

(S.M): As the first auction house, and one of the only organizations in the world, to create its own platform dedicated to NFTs, how is Sotheby’s picking and vetting the pieces?

(S.F.): One of the main things we feel we can bring to the table as an auction house with almost two centuries of experience is our ability to curate our offering to shine a spotlight on important artists and works, showcasing these to our global audience.

Just like everything we do here, we vet the art we offer for its artistic quality as well as vetting it from a compliance standpoint. The rules for NFTs are no different from those we have for anything else we offer. All NFTs featured on Sotheby’s Metaverse or sold in Sotheby's auctions are carefully selected by Sotheby’s NFT specialists to ensure an NFT and the artist's legitimacy. Sotheby’s works directly with the artists and sellers of each NFT to ensure that the artworks are legitimate, authentic, and that they have the right to sell them – all of which can be verified by transparent on-chain data and the meta data embedded in each NFT.

(S.M): What are some of the challenges Sotheby’s is facing in sourcing the pieces?

(S.F.): We believe that our place in this world is our ability to create a scaled and trustworthy marketplace, where buyers can be confident, whilst also curating exciting sales that respond to what our clients want. We have a great specialist team who are passionate and do a lot of research, and are close to many of the artists at the forefront of this field. The challenge is that there is so much out there and so we have to be careful, as we are with all of our other categories, to only bring the best of the best to the market.

(S.M): What differentiates Sotheby’s platform called Metaverse from other NFT marketplaces like OpenSea and Nifty Gateway?

(S.F.): What mainly distinguishes us from other marketplaces is that we present a curated selection. That said, Sotheby’s brings a lot of other unique selling points to the table, from our expertise and curatorial skills to the surety that comes with our brand.

Our Metaverse brings an entirely new dimension to exhibiting, buying and selling NFTs. We bring expertise via our dedicated specialists, who are researching and collaborating with those at the forefront of this space. They are presenting new and exciting sales / projects, as well as bringing traditional collectors into this realm. In our role as curators in this space we are providing a really important platform for these artists, with the lustre of our brand behind them.

I would say that for Sotheby’s, NFTs are an opportunity to be a part of a cultural movement – we are by no means the only platform to be investing a lot of energy and resources into this market. They are here to stay!

(S.M): NFTs have proved to be a lucrative market for Sotheby’s, tell us about your collectors and the types of work they are interested in?

(S.F.): This was a grassroots movement that developed out of the digital world and natively digital artists and so there is already a growing community that is engaged and enamoured by these new digital artefacts. This medium really speaks to them and the mindset they have adopted around ownership and decentralised systems.

Certain collectors prefer some NFTs to others, as with any other field. For example, the Early NFT, historic NFTs from a time when artists were minting in a very experimental way. Others look into the projects with large editions, trying to find the rarest ones or one with special traits. There are also those who are most interested in the artistic aesthetics, one-offs and very unique works.

At the same time, there is a stronger connection between NFTs/digital art and physical art than most people think, and many of the leading digital artists using NFTs are working in a tradition of Minimalist or conceptual artists that are known to the traditional art world. Digital art and NFTs are part of a lineage of art history.

We see lots of potential for cross pollination: our collectors of physical art are showing interest in NFTs, and vice versa. When NFTs really started to take off early this year we received a flood of enquiries and interest from existing clients. Most of them were curious and intrigued about NFTs, others took more convincing, and I think over time more traditional art collectors have come to recognize the importance of digital art and NFTs as a growing movement with real staying power.

(S.M): There is a lot of talk about plagiarism and other issues that are making NFTs controversial so what advice would you give to someone who wants to invest?

(S.F.): All NFTs featured on Sotheby’s Metaverse are curated and intensely vetted by Sotheby’s NFT specialists. Sotheby’s works directly with the artists and collectors of each NFT to ensure that the artworks are legitimate, authentic, and that they have the right to sell them. Sotheby’s Metaverse adheres to the same strict security standards as all Sotheby’s online properties.

(S.M): Can you talk about the importance of the recent three-day digital arts forum at the Diriyah Biennale, in Riyadh, that Sotheby’s hosted in partnership with the Visual Arts Commission of Saudi Arabia’s Ministry of Culture.

(S.F.): The circumstances around our partnership with the Visual Arts Commission of the Ministry of Culture were particularly fortuitous. In late 2021, a delegation from Sotheby’s visited Riyadh for the opening of the Diriyah Biennale and were very much impressed by what they saw. This felt like the perfect setting for launching the first showcase of NFTs in the Kingdom.

We were delighted to be on-the-ground in Riyadh presenting this top tier showcase of NFTs and hosting this series of educational panel discussions on this rapidly evolving digital space. As the Kingdom’s first showcase of NFTs, it presented the two most popular ways of displaying digital art – a physical display (with projectors and screens) and a metaverse display. We curated it as a fulsome survey of NFTs to those who might not be familiar, and the artworks cover the main aspects – from the Early NFT to the Pop Digital genre and Collectibles. These were kindly on loan from international collectors, as well as a gallery.

We were excited to be part of Saudi Arabia’s first foray into the world of NFTs and digital art, a move that positioned Saudi Arabia as a centre for digital innovation. As such, it was important that we spotlighted local artists in the event. We included an NFT by the young, emerging Saudi artist Ahaad Al Amoudi, who lives and works in Jeddah and the panel discussions included two Saudi artists, Al Amoudi herself, but also local visual artist Rashed Al Shashai.

After a jam-packed weekend, we saw that the appetite for this sort of event is huge, which is great to see. The feedback and interest was so exciting and we enjoyed engaging with art enthusiasts on the ground.

(S.M): What do you think the future of NFTs is in the Middle East market?

(S.F.): The Middle East is generally a region that is very digitally advanced and well connected, and so lends itself to this growing area. Both the UAE and Saudi Arabia have a very young demographic (in fact, in KSA, over half of the population is under 25). This is the sort of audience that adapts to and embraces new technologies.

Recently Saudi Arabia announced investments worth $6.4 billion in future technologies, including the metaverse. Similarly, blockchain technologies and cryptocurrency are one of the UAE government’s key priorities and they have major strategies in this area. To add to the strong government support, there is also a lot of institutional activity, from the Art Dubai Digital fair – which took as its focus the online world and NFTs – to the conference at the recently-opened Museum of the Future.

Words by Saira Malik

Images supplied by Sotheby’s